The blockchain gaming sector is shifting to more sustainable economics and has improved sentiment and market maturity as it recalibrates its outlook, reported the Blockchain Game Alliance (BGA).

The Web3 gaming advocacy group said in its annual state of the industry report released on Wednesday that the sector is “moving beyond its speculative origins toward a more operationally disciplined, product-led future.”

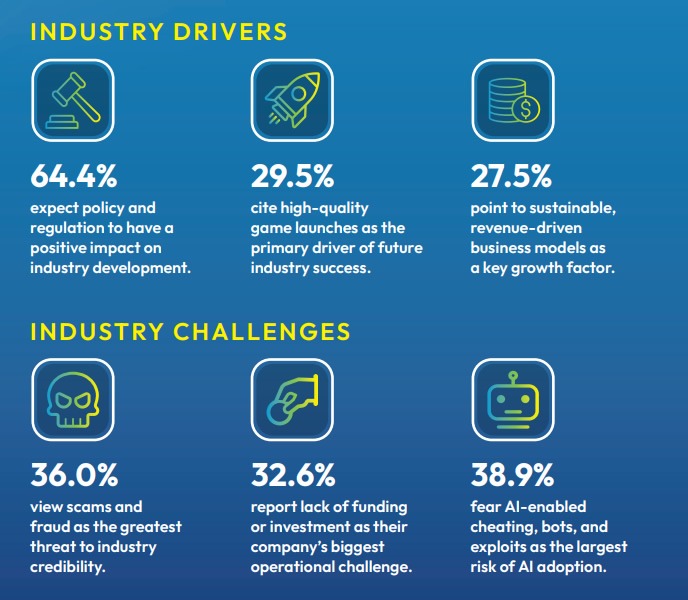

In a survey of over 500 global blockchain gaming professionals, the level of optimism rebounded to 65.8% from its 2024 lows, with the focus shifting from token economics to sustainable revenue models.

“The clearest indicator of the industry’s broader transition lies in its reorientation toward sustainable economics.”

Growth is now anchored in delivering high-quality games, resilient revenue models, and payment infrastructure to support real-world commerce at scale, the report noted.

A tough period for Web3 gaming

Blockchain and Web3 gaming have shifted from peak euphoria in 2021, driven by a play-to-earn explosion and speculative capital, to a low point in 2024, following the collapse of P2E models, a decline in confidence, and a drying up of funding, with studios closing and reputations being damaged.

Related: Investors target ‘fun-first’ crypto games as funding jumps 94% in July

Annual funding dropped dramatically to $293 million in 2025, down from $4 billion in 2021, forcing teams toward leaner, bootstrap-focused operations. Top-tier venture firms paused all new Web3 gaming investments, and project token prices collapsed more than 90% from cycle peaks.

Between 80% and 93% of Web3 games failed, with average lifespans of only months and studios that raised millions couldn’t sustain operations without continuous capital injections.

On the path to recovery

Several developments were cited as contributing factors to the recovery of the beleaguered sector, including regulatory shifts and the growing popularity of stablecoins.

Animoca Brands co-founder Yat Siu said recent crypto-friendly shifts in US regulations mean that companies no longer need to rely on setting up nonprofit foundations when planning token launches.

The BGA said that stablecoins were transformative for Web3 games, they gave gamers “fast, low-cost, borderless transactions without the volatility associated with other crypto assets.”

Additionally, nearly 30% of survey respondents cited high-quality game launches as the most important factor for industry growth.

Immutable’s vice president of global sales, Andrew Sorokovsky, said that “despite the negative headlines, blockchain gaming is now one of crypto’s most proven sectors — where quality projects are thriving and real adoption is taking hold.”

Magazine: XRP’s ‘now or never’ moment, Kalshi taps Solana: Hodler’s Digest